All Categories

Featured

Table of Contents

It's still totally moneyed in the eyes of the common life insurance coverage business. It's vital that your policy is a blended, over-funded, and high-cash worth plan.

Cyclists are extra attributes and benefits that can be contributed to your plan for your particular demands. They let the policyholder purchase much more insurance coverage or alter the problems of future acquisitions. One factor you might wish to do this is to prepare for unanticipated illness as you grow older.

If you include an added $10,000 or $20,000 upfront, you'll have that money to the financial institution from the start. These are simply some steps to take and take into consideration when setting up your way of life banking system. There are several different methods which you can make the many of lifestyle financial, and we can assist you discover te best for you.

What Is A Cash Flow Banking System

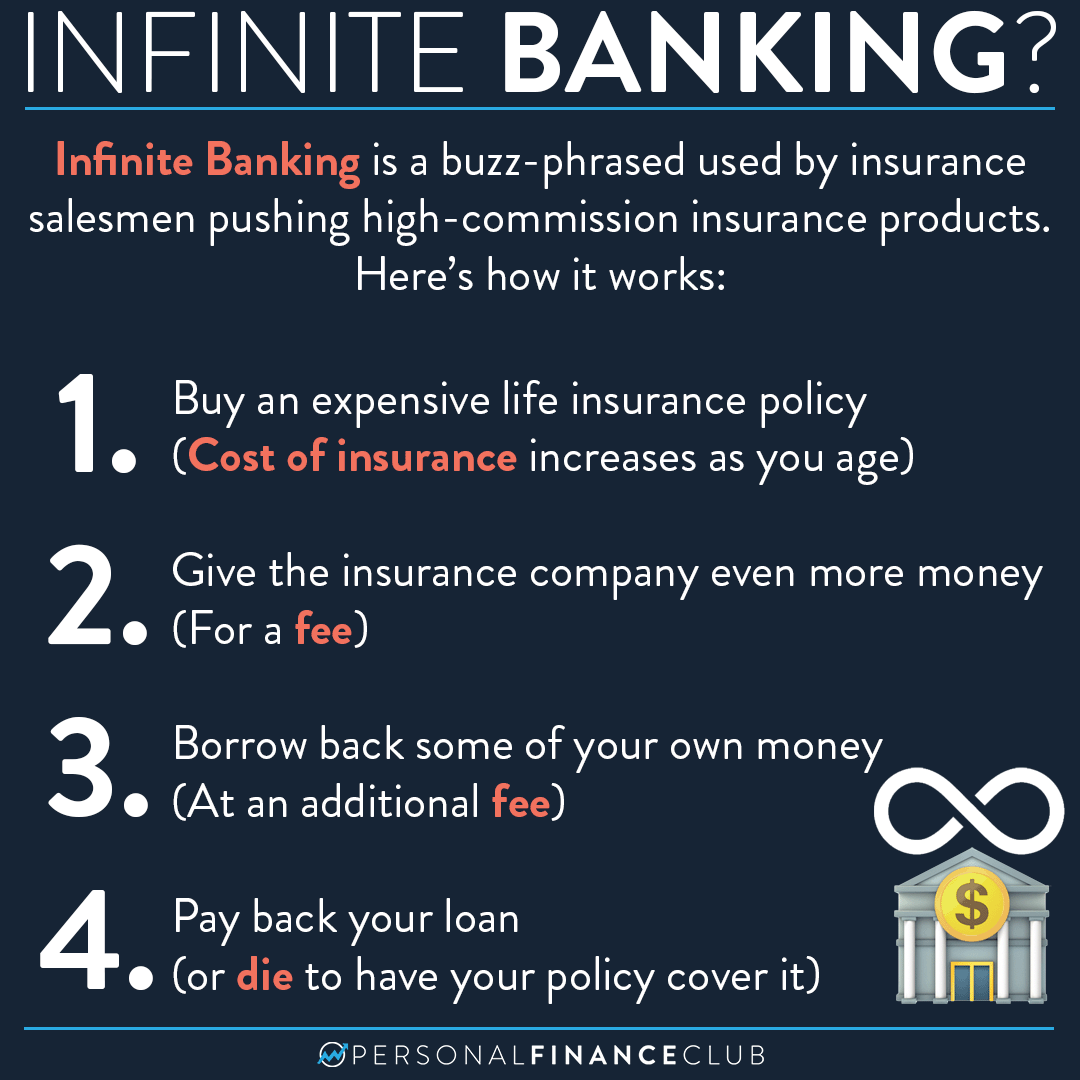

When it comes to economic preparation, entire life insurance frequently stands out as a popular choice. While the idea might sound appealing, it's vital to dig much deeper to recognize what this actually means and why checking out entire life insurance coverage in this means can be misleading.

The concept of "being your own financial institution" is appealing since it suggests a high degree of control over your financial resources. This control can be illusory. Insurance provider have the supreme say in how your plan is managed, including the regards to the fundings and the prices of return on your money worth.

If you're considering whole life insurance policy, it's vital to view it in a wider context. Whole life insurance policy can be an important tool for estate planning, offering a guaranteed survivor benefit to your beneficiaries and possibly offering tax obligation benefits. It can also be a forced savings automobile for those that struggle to conserve cash regularly.

It's a form of insurance coverage with a financial savings element. While it can offer steady, low-risk growth of cash value, the returns are usually lower than what you could achieve through other financial investment automobiles. Before delving into entire life insurance policy with the concept of unlimited financial in mind, make the effort to consider your financial goals, danger tolerance, and the full series of financial items readily available to you.

Unlimited banking is not a monetary remedy. While it can operate in certain situations, it's not without risks, and it requires a substantial dedication and recognizing to take care of properly. By acknowledging the prospective mistakes and comprehending truth nature of entire life insurance, you'll be much better equipped to make an enlightened decision that supports your economic wellness.

As opposed to paying banks for things we require, like autos, houses, and school, we can spend in ways to maintain even more of our cash for ourselves. Infinite Financial method takes an innovative method towards individual finance. The technique basically involves becoming your own financial institution by using a dividend-paying entire life insurance coverage policy as your financial institution.

Ibc Banking Concept

It offers substantial growth with time, changing the typical life insurance policy plan right into a tough monetary tool. While life insurance policy companies and banks risk with the variation of the marketplace, the negates these dangers. Leveraging a cash worth life insurance policy policy, individuals delight in the benefits of ensured development and a fatality advantage secured from market volatility.

The Infinite Banking Idea shows just how much riches is completely moved far from your Family members or Business. Nelson likewise goes on to clarify that "you finance every little thing you buyyou either pay rate of interest to another person or surrender the passion you can have otherwise earned". The actual power of The Infinite Banking Concept is that it addresses for this issue and equips the Canadians that welcome this idea to take the control back over their financing needs, and to have that money receding to them versus away.

This is called shed opportunity expense. When you pay cash for things, you completely give up the chance to gain rate of interest by yourself financial savings over multiple generations. To address this issue, Nelson created his own financial system through making use of returns paying getting involved entire life insurance plans, ideally through a common life company.

As an outcome, insurance holders should thoroughly evaluate their financial goals and timelines before choosing this method. Register for our Infinite Financial Training Course. Recapture the passion that you pay to banks and finance companies for the significant products that you need during a life time. Develop and keep your Personal/ Company wide range without Bay Street or Wall Surface Street.

Infinitebanking Org

Bear in mind, The unlimited Banking Concept is a procedure and it can radically boost everything that you are already performing in your current monetary life. Exactly how to get undisturbed worsening on the routine contributions you make to your financial savings, emergency fund, and pension How to position your hard-earned cash to ensure that you will never have an additional sleep deprived night fretted regarding just how the markets are going to react to the next unfiltered Governmental TWEET or worldwide pandemic that your family members merely can not recover from Just how to pay yourself first making use of the core principles instructed by Nelson Nash and win at the cash video game in your very own life How you can from 3rd party banks and lenders and relocate right into your very own system under your control A streamlined means to make certain you pass on your wealth the method you desire on a tax-free basis How you can move your cash from permanently taxed accounts and shift them right into Never ever strained accounts: Hear precisely just how people similar to you can execute this system in their very own lives and the impact of placing it into activity! That developing your very own "Infinite Banking System" or "Wealth System" is possibly one of the most fantastic approach to shop and shield your cash circulation in the country How implementing The Infinite Banking Refine can create a generation ripple effect and show real stewardship of cash for numerous generations Just how to be in the vehicle driver's seat of your monetary fate and ultimately create that is safeguarded and just goes one directionUP! The period for developing and making considerable gains via boundless financial largely depends on different factors unique to an individual's monetary placement and the plans of the economic institution providing the service.

Moreover, an annual reward repayment is an additional massive benefit of Infinite banking, further highlighting its good looks to those geared in the direction of long-lasting monetary development. However, this method requires careful factor to consider of life insurance policy prices and the analysis of life insurance policy quotes. It's essential to analyze your credit score report and challenge any type of existing debt card financial obligation to make certain that you are in a positive placement to embrace the strategy.

A vital element of this strategy is that there is insensitivity to market changes, because of the nature of the non-direct recognition car loans utilized. Unlike financial investments connected to the volatility of the marketplaces, the returns in unlimited banking are steady and foreseeable. Additional money over and over the costs payments can additionally be added to speed up development.

Infinite Banking Reddit

Insurance holders make regular premium repayments into their taking part entire life insurance policy policy to keep it in force and to build the plan's complete cash money worth. These superior repayments are commonly structured to be consistent and predictable, making certain that the plan stays energetic and the money value proceeds to expand over time.

The life insurance policy policy is made to cover the entire life of a specific, and not simply to help their recipients when the specific passes away. That stated, the policy is getting involved, meaning the plan owner ends up being a component proprietor of the life insurance policy firm, and takes part in the divisible profit produced in the type of rewards.

When dividends are chunked back right into the plan to acquire paid up additions for no added cost, there is no taxable occasion. And each paid up addition additionally obtains returns every single year they're declared. r nelson nash infinite banking concept.

Table of Contents

Latest Posts

Ibc Banking Concept

Specially Designed Life Insurance

Infinite Banking Solution

More

Latest Posts

Ibc Banking Concept

Specially Designed Life Insurance

Infinite Banking Solution